10. How to Pay for a War: Part 2#

Contents

In addition to what’s in Anaconda, this lecture deploys the quantecon library:

!pip install --upgrade quantecon

Show code cell output

Requirement already satisfied: quantecon in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (0.7.1)

Requirement already satisfied: numba>=0.49.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from quantecon) (0.57.1)

Requirement already satisfied: numpy>=1.17.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from quantecon) (1.24.3)

Requirement already satisfied: requests in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from quantecon) (2.31.0)

Requirement already satisfied: scipy>=1.5.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from quantecon) (1.11.1)

Requirement already satisfied: sympy in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from quantecon) (1.11.1)

Requirement already satisfied: llvmlite<0.41,>=0.40.0dev0 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from numba>=0.49.0->quantecon) (0.40.0)

Requirement already satisfied: charset-normalizer<4,>=2 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from requests->quantecon) (2.0.4)

Requirement already satisfied: idna<4,>=2.5 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from requests->quantecon) (3.4)

Requirement already satisfied: urllib3<3,>=1.21.1 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from requests->quantecon) (1.26.16)

Requirement already satisfied: certifi>=2017.4.17 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from requests->quantecon) (2023.7.22)

Requirement already satisfied: mpmath>=0.19 in /usr/share/miniconda3/envs/quantecon/lib/python3.11/site-packages (from sympy->quantecon) (1.3.0)

10.1. An Application of Markov Jump Linear Quadratic Dynamic Programming#

This is a sequel to an earlier lecture.

We use a method introduced in lecture Markov Jump LQ dynamic programming to implement suggestions by Barro (1999 [Bar99], 2003 [BM03]) for extending his classic 1979 model of tax smoothing.

Barro’s 1979 [Bar79] model is about a government that borrows and lends in order to help it minimize an intertemporal measure of distortions caused by taxes.

Technically, Barro’s 1979 [Bar79] model looks a lot like a consumption-smoothing model.

Our generalizations of his 1979 [Bar79] model will also look like souped-up consumption-smoothing models.

Wanting tractability induced Barro in 1979 [Bar79] to assume that

the government trades only one-period risk-free debt, and

the one-period risk-free interest rate is constant

In our earlier lecture, we relaxed the second of these assumptions but not the first.

In particular, we used Markov jump linear quadratic dynamic programming to allow the exogenous interest rate to vary over time.

In this lecture, we add a maturity composition decision to the government’s problem by expanding the dimension of the state.

We assume

that the government borrows or saves in the form of risk-free bonds of maturities \(1, 2, \ldots , H\).

that interest rates on those bonds are time-varying and in particular are governed by a jointly stationary stochastic process.

Let’s start with some standard imports:

import quantecon as qe

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

10.2. Two example specifications#

We’ll describe two possible specifications

In one, each period the government issues zero-coupon bonds of one- and two-period maturities and redeems them only when they mature – in this version, the maturity structure of government debt at each date is partly inherited from the past.

In the second, the government redesigns the maturity structure of the debt each period.

10.3. One- and Two-period Bonds but No Restructuring#

Let \(T_t\) denote tax collections, \(\beta\) a discount factor, \(b_{t,t+1}\) time \(t+1\) goods that the government promises to pay at \(t\), \(b_{t,t+2}\) time \(t+2\) goods that the government promises to pay at time \(t\), \(G_t\) government purchases, \(p_{t,t+1}\) the number of time \(t\) goods received per time \(t+1\) goods promised, and \(p_{t,t+2}\) the number of time \(t\) goods received per time \(t+2\) goods promised.

Evidently, \(p_{t, t+1}, p_{t,t+2}\) are inversely related to appropriate corresponding gross interest rates on government debt.

In the spirit of Barro (1979) [Bar79], government expenditures are governed by an exogenous stochastic process.

Given initial conditions \(b_{-2,0}, b_{-1,0}, z_0, i_0\), where \(i_0\) is the initial Markov state, the government chooses a contingency plan for \(\{b_{t, t+1}, b_{t,t+2}, T_t\}_{t=0}^\infty\) to maximize.

subject to the constraints

Here \(w_{t+1} \sim {\cal N}(0,I)\) and \(\Pi_{ij}\) is the probability that the Markov state moves from state \(i\) to state \(j\) in one period.

The variables \(T_t, b_{t, t+1}, b_{t,t+2}\) are control variables chosen at \(t\), while the variables \(b_{t-1,t}, b_{t-2,t}\) are endogenous state variables inherited from the past at time \(t\) and \(p_{t,t+1}, p_{t,t+2}\) are exogenous state variables at time \(t\).

The parameter \(c_1\) imposes a penalty on the government’s issuing different quantities of one and two-period debt.

This penalty deters the government from taking large “long-short” positions in debt of different maturities. An example below will show this in action.

As well as extending the model to allow for a maturity decision for government debt, we can also in principle allow the matrices \(U_{g,s_t}, A_{22,s_t}, C_{2,s_t}\) to depend on the Markov state \(s_t\).

Below, we will often adopt the convention that for matrices appearing in a linear state space, \(A_t \equiv A_{s_t}, C_t \equiv C_{s_t}\) and so on, so that dependence on \(t\) is always intermediated through the Markov state \(s_t\).

10.4. Mapping into an LQ Markov Jump Problem#

First, define

which is debt due at time \(t\).

Then define the endogenous part of the state:

and the complete state

and the control vector

The endogenous part of state vector follows the law of motion:

or

Define the following functions of the state

and

where \(p_{t,t+1}\) is the discount on one period loans in the discrete Markov state at time \(t\) and \(p_{t,t+2}\) is the discount on two-period loans in the discrete Markov state.

Define

Note that in discrete Markov state \(i\)

It follows that

or

where

Because the payoff function also includes the penalty parameter on issuing debt of different maturities, we have:

where \(Q^c = \begin{bmatrix} 1 & -1 \\ -1 & 1 \end{bmatrix}\). Therefore, the overall \(Q\) matrix for the Markov jump LQ problem is:

The law of motion of the state in all discrete Markov states \(i\) is

where

Thus, in this problem all the matrices apart from \(B\) may depend on the Markov state at time \(t\).

As shown in the previous lecture,

the LQMarkov class can solve Markov jump LQ problems when provided with the

\(A, B, C, R, Q, W\) matrices for each Markov state.

The function below maps the primitive matrices and parameters from the above

two-period model into the matrices that the LQMarkov class requires:

def LQ_markov_mapping(A22, C2, Ug, p1, p2, c1=0):

"""

Function which takes A22, C2, Ug, p_{t, t+1}, p_{t, t+2} and penalty

parameter c1, and returns the required matrices for the LQMarkov

model: A, B, C, R, Q, W.

This version uses the condensed version of the endogenous state.

"""

# Make sure all matrices can be treated as 2D arrays

A22 = np.atleast_2d(A22)

C2 = np.atleast_2d(C2)

Ug = np.atleast_2d(Ug)

p1 = np.atleast_2d(p1)

p2 = np.atleast_2d(p2)

# Find the number of states (z) and shocks (w)

nz, nw = C2.shape

# Create A11, B1, S1, S2, Sg, S matrices

A11 = np.zeros((2, 2))

A11[0, 1] = 1

B1 = np.eye(2)

S1 = np.hstack((np.eye(1), np.zeros((1, nz+1))))

Sg = np.hstack((np.zeros((1, 2)), Ug))

S = S1 + Sg

# Create M matrix

M = np.hstack((-p1, -p2))

# Create A, B, C matrices

A_T = np.hstack((A11, np.zeros((2, nz))))

A_B = np.hstack((np.zeros((nz, 2)), A22))

A = np.vstack((A_T, A_B))

B = np.vstack((B1, np.zeros((nz, 2))))

C = np.vstack((np.zeros((2, nw)), C2))

# Create Q^c matrix

Qc = np.array([[1, -1], [-1, 1]])

# Create R, Q, W matrices

R = S.T @ S

Q = M.T @ M + c1 * Qc

W = M.T @ S

return A, B, C, R, Q, W

With the above function, we can proceed to solve the model in two steps:

Use

LQ_markov_mappingto map \(U_{g,t}, A_{22,t}, C_{2,t}, p_{t,t+1}, p_{t,t+2}\) into the \(A, B, C, R, Q, W\) matrices for each of the \(n\) Markov states.Use the

LQMarkovclass to solve the resulting n-state Markov jump LQ problem.

10.5. Penalty on Different Issuance Across Maturities#

To implement a simple example of the two-period model, we assume that \(G_t\) follows an AR(1) process:

To do this, we set \(z_t = \begin{bmatrix} 1 \\ G_t \end{bmatrix}\), and consequently:

Therefore, in this example, \(A_{22}, C_2\) and \(U_g\) are not time-varying.

We will assume that there are two Markov states, one with a flatter yield curve, and one with a steeper yield curve. In state 1, prices are:

and in state 2, prices are:

We first solve the model with no penalty parameter on different issuance across maturities, i.e. \(c_1 = 0\).

We also need to specify a transition matrix for the Markov state, we use:

Thus, each Markov state is persistent, and there is an equal chance of moving from one to the other.

# Model parameters

β, Gbar, ρ, σ, c1 = 0.95, 5, 0.8, 1, 0

p1, p2, p3, p4 = β, β**2 - 0.02, β, β**2 + 0.02

# Basic model matrices

A22 = np.array([[1, 0], [Gbar, ρ] ,])

C_2 = np.array([[0], [σ]])

Ug = np.array([[0, 1]])

A1, B1, C1, R1, Q1, W1 = LQ_markov_mapping(A22, C_2, Ug, p1, p2, c1)

A2, B2, C2, R2, Q2, W2 = LQ_markov_mapping(A22, C_2, Ug, p3, p4, c1)

# Small penalties on debt required to implement no-Ponzi scheme

R1[0, 0] = R1[0, 0] + 1e-9

R2[0, 0] = R2[0, 0] + 1e-9

# Construct lists of matrices correspond to each state

As = [A1, A2]

Bs = [B1, B2]

Cs = [C1, C2]

Rs = [R1, R2]

Qs = [Q1, Q2]

Ws = [W1, W2]

Π = np.array([[0.9, 0.1],

[0.1, 0.9]])

# Construct and solve the model using the LQMarkov class

lqm = qe.LQMarkov(Π, Qs, Rs, As, Bs, Cs=Cs, Ns=Ws, beta=β)

lqm.stationary_values()

# Simulate the model

x0 = np.array([[100, 50, 1, 10]])

x, u, w, t = lqm.compute_sequence(x0, ts_length=300)

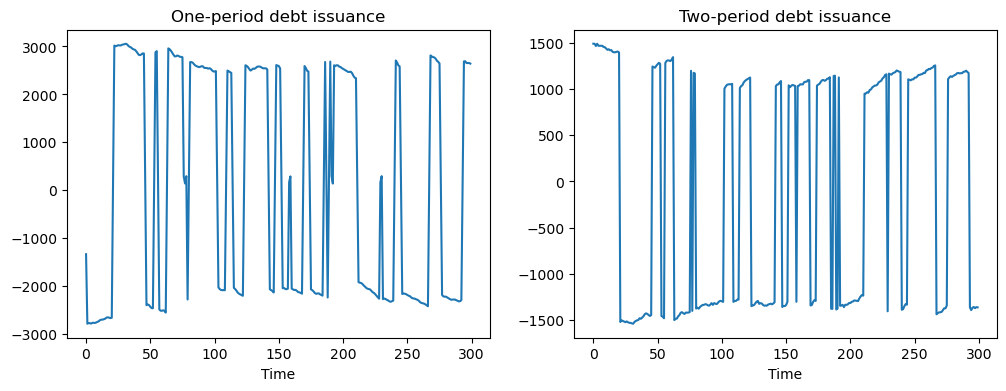

# Plot of one and two-period debt issuance

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 4))

ax1.plot(u[0, :])

ax1.set_title('One-period debt issuance')

ax1.set_xlabel('Time')

ax2.plot(u[1, :])

ax2.set_title('Two-period debt issuance')

ax2.set_xlabel('Time')

plt.show()

The above simulations show that when no penalty is imposed on different issuances across maturities, the government has an incentive to take large “long-short” positions in debt of different maturities.

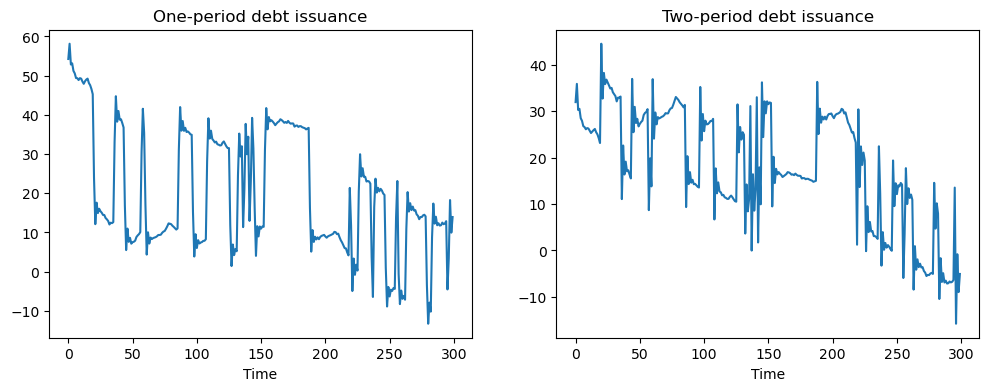

To prevent such an outcome, we now set \(c_1 = 0.01\).

This penalty is enough to ensure that the government issues positive quantities of both one and two-period debt:

# Put small penalty on different issuance across maturities

c1 = 0.01

A1, B1, C1, R1, Q1, W1 = LQ_markov_mapping(A22, C_2, Ug, p1, p2, c1)

A2, B2, C2, R2, Q2, W2 = LQ_markov_mapping(A22, C_2, Ug, p3, p4, c1)

# Small penalties on debt required to implement no-Ponzi scheme

R1[0, 0] = R1[0, 0] + 1e-9

R2[0, 0] = R2[0, 0] + 1e-9

# Construct lists of matrices

As = [A1, A2]

Bs = [B1, B2]

Cs = [C1, C2]

Rs = [R1, R2]

Qs = [Q1, Q2]

Ws = [W1, W2]

# Construct and solve the model using the LQMarkov class

lqm2 = qe.LQMarkov(Π, Qs, Rs, As, Bs, Cs=Cs, Ns=Ws, beta=β)

lqm2.stationary_values()

# Simulate the model

x, u, w, t = lqm2.compute_sequence(x0, ts_length=300)

# Plot of one and two-period debt issuance

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 4))

ax1.plot(u[0, :])

ax1.set_title('One-period debt issuance')

ax1.set_xlabel('Time')

ax2.plot(u[1, :])

ax2.set_title('Two-period debt issuance')

ax2.set_xlabel('Time')

plt.show()

10.6. A Model with Restructuring#

This model alters two features of the previous model:

The maximum horizon of government debt is now extended to a general H periods.

The government is able to redesign the maturity structure of debt every period.

We impose a cost on adjusting issuance of each maturity by amending the payoff function to become:

The government’s budget constraint is now:

To map this into the Markov Jump LQ framework, we define state and control variables.

Let:

Thus, \(\bar b_t\) is the endogenous state (debt issued last period) and \(u_t\) is the control (debt issued today).

As before, we will also have the exogenous state \(z_t\), which determines government spending.

Therefore, the full state is:

We also define a vector \(p_t\) that contains the time \(t\) price of goods in period \(t + j\):

Finally, we define three useful matrices \(S_s, S_x, \tilde S_x\):

In terms of dimensions, the first two matrices defined above are \((H-1) \times H\).

The last is \(1 \times H\)

We can now write the government’s budget constraint in matrix notation. Rearranging the government budget constraint gives:

or

If we want to write this in terms of the full state, we have:

To simplify the notation, let \(S_t = \begin{bmatrix} (\tilde S_x + p_t’S_s’S_x) & Ug \end{bmatrix}\).

Then

Therefore

where

where to economize on notation we adopt the convention that for the linear state matrices \(R_t \equiv R_{s_t}, Q_t \equiv W_{s_t}\) and so on.

We’ll continue to use this convention also for the linear state matrices \(A, B, W\) and so on below.

Because the payoff function also includes the penalty parameter for rescheduling, we have:

Because the complete state is \(x_t\) and not \(\bar b_t\), we rewrite this as:

where \(S_c = \begin{bmatrix} I & 0 \end{bmatrix}\)

Multiplying this out gives:

Therefore, with the cost term, we must amend our \(R,Q,W\) matrices as follows:

To finish mapping into the Markov jump LQ setup, we need to construct the law of motion for the full state.

This is simpler than in the previous setup, as we now have \(\bar b_{t+1} = u_t\).

Therefore:

where

This completes the mapping into a Markov jump LQ problem.

10.7. Restructuring as a Markov Jump Linear Quadratic Control Problem#

As with the previous model, we can use a function to map the primitives

of the model with restructuring into the matrices that the LQMarkov

class requires:

def LQ_markov_mapping_restruct(A22, C2, Ug, T, p_t, c=0):

"""

Function which takes A22, C2, T, p_t, c and returns the

required matrices for the LQMarkov model: A, B, C, R, Q, W

Note, p_t should be a T by 1 matrix

c is the rescheduling cost (a scalar)

This version uses the condensed version of the endogenous state

"""

# Make sure all matrices can be treated as 2D arrays

A22 = np.atleast_2d(A22)

C2 = np.atleast_2d(C2)

Ug = np.atleast_2d(Ug)

p_t = np.atleast_2d(p_t)

# Find the number of states (z) and shocks (w)

nz, nw = C2.shape

# Create Sx, tSx, Ss, S_t matrices (tSx stands for \tilde S_x)

Ss = np.hstack((np.eye(T-1), np.zeros((T-1, 1))))

Sx = np.hstack((np.zeros((T-1, 1)), np.eye(T-1)))

tSx = np.zeros((1, T))

tSx[0, 0] = 1

S_t = np.hstack((tSx + p_t.T @ Ss.T @ Sx, Ug))

# Create A, B, C matrices

A_T = np.hstack((np.zeros((T, T)), np.zeros((T, nz))))

A_B = np.hstack((np.zeros((nz, T)), A22))

A = np.vstack((A_T, A_B))

B = np.vstack((np.eye(T), np.zeros((nz, T))))

C = np.vstack((np.zeros((T, nw)), C2))

# Create cost matrix Sc

Sc = np.hstack((np.eye(T), np.zeros((T, nz))))

# Create R_t, Q_t, W_t matrices

R_c = S_t.T @ S_t + c * Sc.T @ Sc

Q_c = p_t @ p_t.T + c * np.eye(T)

W_c = -p_t @ S_t - c * Sc

return A, B, C, R_c, Q_c, W_c

10.7.1. Example with Restructuring#

As an example of the model with restructuring, consider this model where \(H = 3\).

We will assume that there are two Markov states, one with a flatter yield curve, and one with a steeper yield curve.

In state 1, prices are:

and in state 2, prices are:

We will assume the same transition matrix and \(G_t\) process as above

# New model parameters

H = 3

p1 = np.array([[0.9695], [0.902], [0.8369]])

p2 = np.array([[0.9295], [0.902], [0.8769]])

Pi = np.array([[0.9, 0.1], [0.1, 0.9]])

# Put penalty on different issuance across maturities

c2 = 0.5

A1, B1, C1, R1, Q1, W1 = LQ_markov_mapping_restruct(A22, C_2, Ug, H, p1, c2)

A2, B2, C2, R2, Q2, W2 = LQ_markov_mapping_restruct(A22, C_2, Ug, H, p2, c2)

# Small penalties on debt required to implement no-Ponzi scheme

R1[0, 0] = R1[0, 0] + 1e-9

R1[1, 1] = R1[1, 1] + 1e-9

R1[2, 2] = R1[2, 2] + 1e-9

R2[0, 0] = R2[0, 0] + 1e-9

R2[1, 1] = R2[1, 1] + 1e-9

R2[2, 2] = R2[2, 2] + 1e-9

# Construct lists of matrices

As = [A1, A2]

Bs = [B1, B2]

Cs = [C1, C2]

Rs = [R1, R2]

Qs = [Q1, Q2]

Ws = [W1, W2]

# Construct and solve the model using the LQMarkov class

lqm3 = qe.LQMarkov(Π, Qs, Rs, As, Bs, Cs=Cs, Ns=Ws, beta=β)

lqm3.stationary_values()

x0 = np.array([[5000, 5000, 5000, 1, 10]])

x, u, w, t = lqm3.compute_sequence(x0, ts_length=300)

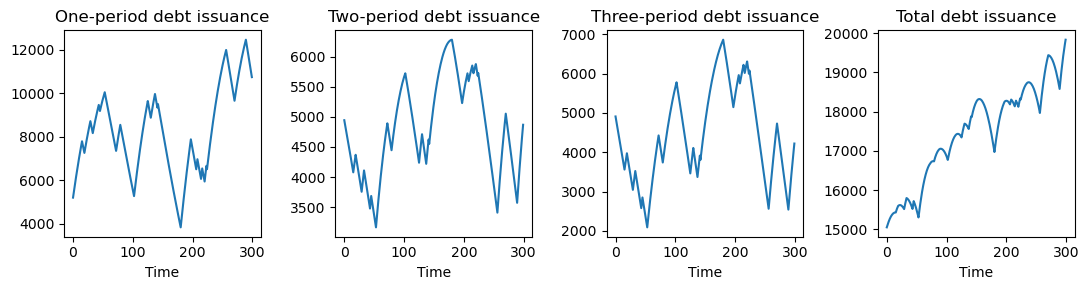

# Plots of different maturities debt issuance

fig, (ax1, ax2, ax3, ax4) = plt.subplots(1, 4, figsize=(11, 3))

ax1.plot(u[0, :])

ax1.set_title('One-period debt issuance')

ax1.set_xlabel('Time')

ax2.plot(u[1, :])

ax2.set_title('Two-period debt issuance')

ax2.set_xlabel('Time')

ax3.plot(u[2, :])

ax3.set_title('Three-period debt issuance')

ax3.set_xlabel('Time')

ax4.plot(u[0, :] + u[1, :] + u[2, :])

ax4.set_title('Total debt issuance')

ax4.set_xlabel('Time')

plt.tight_layout()

plt.show()

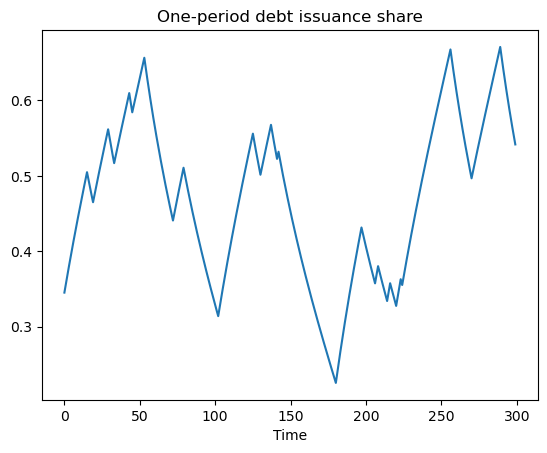

# Plot share of debt issuance that is short-term

fig, ax = plt.subplots()

ax.plot((u[0, :] / (u[0, :] + u[1, :] + u[2, :])))

ax.set_title('One-period debt issuance share')

ax.set_xlabel('Time')

plt.show()